$2.4M Run Rate in 90 Days: How One Skincare Brand Doubled Profit Without Burning Ad Spend

In the ultra-competitive world of Amazon beauty and skincare, most brands plateau far before they truly scale. Many hit $100K/month in revenue only to flatline—hemorrhaging cash on PPC, watching margins erode, and riding the hamster wheel of “spend more to grow less.”

But this brand’s story was different.

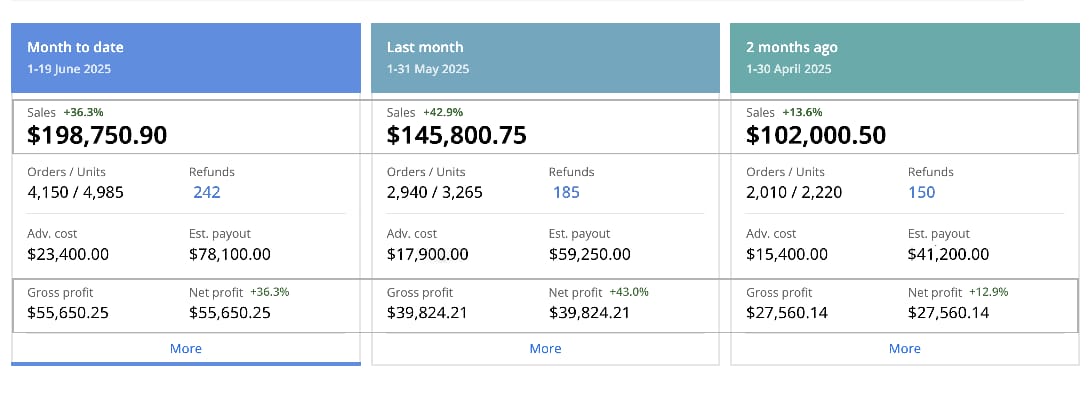

Within just 3 months of partnering with our team at NixAds, a premium U.S. skincare label shattered its ceiling:

- ✅ Revenue nearly doubled, from $102K to $198K/month

- ✅ Net profit jumped 102%

- ✅ ACoS dropped from 15.1% to 11.7%

- ✅ TACoS sank from 10.75% to 8.45%

And they’re now on track to hit $350K/month—without compromising on profitability.

Where They Started: A Stuck Brand in a Saturated Niche

Despite selling 18 well-positioned SKUs in the premium skincare category, the brand was trapped in a typical Amazon cycle: spending just to maintain rank. Campaigns were fragmented, bloated, and built on assumptions—not profitability.

- Category: Premium Face & Body Care

- Marketplace: United States

- Fulfillment: FBA

- Sales Split: 38% PPC | 62% Organic

Their performance was “fine”—but in beauty, fine is forgettable.

The 90-Day Transformation: Key Metrics

| Metric | Before | After | Growth |

| Monthly Revenue | $102K | $198K | ↑ 94% |

| Net Profit | $27.5K | $55.6K | ↑ 102% |

| ACoS | 15.1% | 11.7% | ↓ 3.4% |

| TACoS | 10.75% | 8.45% | ↓ 2.3% |

Profit-First PPC Restructuring: The Foundation of Growth

We started by ditching every bloated campaign and began from a blank canvas.

- CVR-Based Segmentation: Only keywords and SKUs with proven conversion potential were scaled.

- Profit Threshold Mapping: Each SKU had a custom break-even ACoS, and bidding strategies were aligned accordingly.

- Negative Targeting Audit: Weekly heatmaps and conversion data fed into aggressive negative targeting to reduce waste.

This level of PPC hygiene turned paid ads from a cost center into a revenue multiplier.

Building Organic Momentum With Purpose

Instead of waiting for organic sales to “kick in,” we made it happen through:

- Amazon Posts infused with influencer-generated content

- External traffic from Pinterest and TikTok retargeting audiences

- Pairing high-LTV SKUs with underperforming ASINs for portfolio lift

Result? 62% of total sales went organic, fueling a sustainable engine that compounded returns from paid efforts.

Operational Leverage Most Brands Overlook

Ads alone don’t scale a brand. So, we tightened operational belts:

- Daily Buy Box sweeps to protect margin and detour hijackers

- Smart PPC throttling based on SKU-specific sell-through velocity

- UX optimizations that aligned customer expectations, reducing refunds by 12%

These non-ad levers created margin safety nets and pricing power—critical during Q4 volatility.

Setting the Stage for $350K/Month

With systems in place, we’re now scaling toward a clear target: 📈 $350K/month in revenue with sub-12% ACoS discipline

Key moves ahead:

- Expanding high-CVR SKUs into adjacent categories

- Unlocking Amazon’s Premium Beauty placements through data-backed negotiations

- Defending margins during Q4 with automated hijacker and Buy Box sweeps

This isn’t growth through hacks—it’s growth through infrastructure.

Final Takeaway: Profit Before Hype, Strategy Before Spend

Most brands think they have a PPC problem—what they really have is a clarity problem. Scaling on Amazon today means optimizing ecosystems, not just ads.

If you’re a beauty or wellness brand doing $50K–$200K/month and looking to:

- Slash wasted spend

- Scale without margin erosion

- Build a repeatable growth loop

You don’t need more hype. You need discipline, frameworks, and a partner that understands both.

Let’s talk about strategy.